Gold-to-Silver Ratio Suggest Silver Prices Could Soar

Stocks have certainly done well in the past few years, but there’s one asset that remains ignored and has massive upside potential. It could outperform stocks easily. It’s silver. As it stands, silver prices trade for very cheap valuations. Ignoring the precious metal could really be a big mistake.

Why is silver worth a look?

Currently, silver prices are trading at a massive discount compared to gold prices.

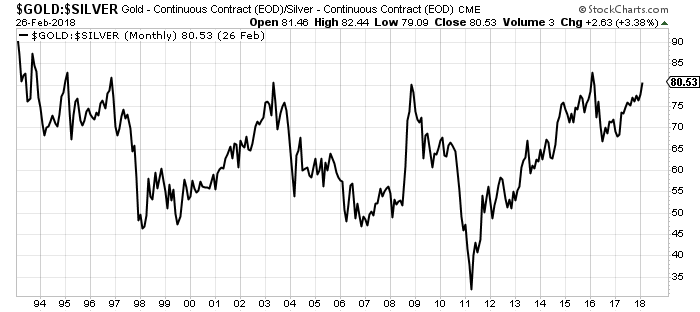

Just look at the chart below. It shows the gold-to-silver ratio. Essentially, this ratio tells us how many ounces of silver it takes to buy one ounce of gold. Gold investors use this ratio to figure out the value of silver.

The gold-to-silver ratio stands at around 80.53. This means it takes 80.53 ounces of silver to buy one ounce of gold.

But pay a little more attention to the chart.

Chart courtesy of StockCharts.com

In the last 22 years, we have seen something very interesting on this ratio…

Whenever the gold-to-silver ratio reaches around 80, it drops lower to around 45. Since 1996, this ratio has reached 80 and then dropped to around 45 at least three times.

With the gold-to-silver ratio standing above 80 now, it must be questioned what happens if this ratio drops to 45.

You see, if we assume gold prices remain the same (at around $1,320), then silver prices would have to reach around $29.55 for the ratio to hit 45.

That’s roughly 80% higher than where silver prices currently trade.

The long-term average of the gold-to-silver ratio since the 1970s is around 56.61. If we assume that the ratio falls to this level, silver prices would have to increase to around $23.50.

This is roughly 42% higher than the current silver price.

Keep in mind, constant gold prices were used to come to these silver prices. If gold prices go up, silver could go much higher.

Silver Prices Outlook: 2018 Could Be Great for Those Who Own Silver

Dear reader, it can’t be stressed enough: silver is worth a look. The gray precious metal is presenting a great opportunity at the current price.

Over the past few months, silver prices have remained flat. This was mainly due to investors thinking that precious metals are a bad investment in times of rising interest rates.

Don’t get too swayed by this narrative.

Silver, hands down, remains one of the most undervalued assets out there. As it has been ignored, the fundamentals of silver markets have improved immensely. No matter where you look, the case for higher silver prices is getting stronger every day. The gold-to-silver ratio is just one indicator painting a bullish picture for the precious metal.

I believe the later part of 2018 could be the time when we see fireworks in the gray precious metal.

In the meantime, I am paying a lot of attention to silver miners. Especially those that have worked over the last few years to reduce their costs of production, have spent money on exploration, and have a respectable amount of reserves and resources. Why? If silver prices soar, these miners could see their stock prices skyrocket.